- Home

- Episode descriptions

- Denis Nelthorpe

- Jasmin Dorrington

- Jon Denovan

- Paul Bingham

- Carolyn Bond

- Teresa Corbin

- Raj Venga

- Gerard Brody

- Abe Arends

- Peter Cousins

- Emma Swart

- Kimberley Maeyaert

- Randal Dennings

- Noel Nunan

- Theresa Jennings

- Michael Forde

- Brian Herd

- Kieren Pender

- Margaret Arthur

- Paul O’Shea

- Reeanna Maloney

- Mark Lombard

- Tracey Kariwo

- Harry Fong

- Denis McMahon

- Robyna May

- Noel Whittaker

- Susan Bryant

- John Berrill

- Kat Lane

- Amanda Sinclair

- Steve Irvine

- Angelica Kopec

- Shahleena Musk

- Simon Cleary

- Justin Malbon

- Frank Garcia

- Lunching Blog

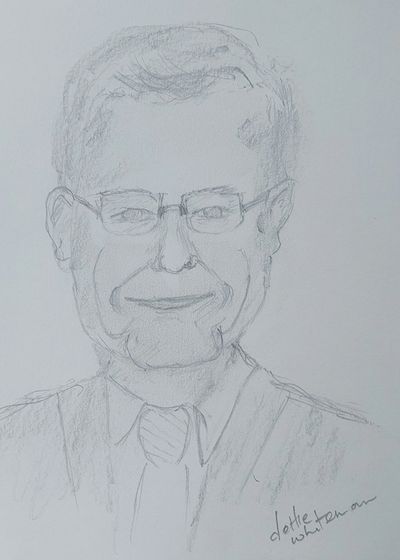

Paul Bingham

Paul Bingham

Paul Bingham is a barrister having practised at the Victorian Bar since 1991.

He was admitted as a solicitor in 1982. Paul is the co-author of the Credit

Handbook and contributor to Fitzroy Legal Service Handbook. He practises in

superannuation and insurance, financial advice, administrative, building,

credit, banking, finance and general commercial law and was a member of the

Social Security Appeals Tribunal and the Superannuation Complaints Tribunal

Paul was previously a Financial Counsellor, Solicitor, University Lecturer and

Ministerial Adviser. In 2013 he was awarded the 2013 Victorian Bar Pro Bono

Trophy for his extraordinary commitment to advocacy for low income and

vulnerable consumers

Paul and I talk about:

The class system in England and why he came to Australia

Being terrified by the late Professor Sandford “Sandy” Clark at

Melbourne university an expert in water law

Landing his first job (as a financial counsellor) wearing his father’s

safari suit

How working as a financial counsellor brought him back to the law

Having a strong sense that the law was an instrument of oppression

How a common vision of using the law to fight for low income rights led

to the establishment of the Consumer credit legal service

why locating the first office in the metal workers building was useful

How its possible for very different personalities to work together if you

have the same vision

Running the Household licensing case with Denis Nelthorpe and

winning against two Queens Counsel and 3 juniors. 3 of his opponents

were future judges. Stephen Charles KC OA who served on the

Supreme Court of Victoria 1995 to 2006 David Habersberger KC who

served on the Supreme Court of Victoria 2001 to 2013

Working as an advisor in the Joan Kirner government and how a

cabinet reshuffle meant you were out of a job

Training as a barrister

How he got into challenging trustee and insurer decisions under

superannuation policies.

How insurers have made it really difficult for people to claim under their

superannuation policies for disablement

Initially jurisprudence favoured insurers but over time there has been a

more balance approach

How the insurance industry managed to get a revision of the insurance

contracts Act (1984) in 2013 that considerably cut back consumer

rights s commented on in the Haynes Royal commission

How the lack of consumer advocacy in this area as well as the power

of the insurance industry allowed the industry to have the law changed

to benefit the industry at the expense of consumers. ,

One of the reasons why insurers wanted to law changed was that they

had underpriced policies because they thought people would nor claim

the definition of “activities of daily living” are an issue in life

policies

How covid has redefined his practice. Giving up his chambers after 15

years.

His view that mediations, trials and the practice of a barrister can

largely be conducted online

Genuinely being very fond of his solicitors who give him work, being

flexible and available and not charging for every piece of work if they

just want to discuss something as a means of building great

relationships

If you want to find out more about Paul contact him through linkedin or drop

me a line through the website www.lorettakreet.com.

#paulbingham #victoriabar #legalpodcast #lunchingwithlawers #lorettakreet #barrister

#superannuation #insurancelaw

Website and podcasts moderated and managed by Frances Lockhart

Copyright © 2019 LorettaKreet.com - All Rights Reserved.

Sound editing by Oliver Galke